25+ tax returns for mortgage

Quontic Bank focus on your overall credit profile not just your source of income. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1 million.

Pwc Myanmar Business Guide

Of those people who finance a purchase nearly 90 of them opt for a 30-year fixed rate.

. 25900 for tax year 2022 Heads of household. Web Can reportable interest be claimed by more than one person on their income tax return. We cant provide tax advice.

Ad Get a mortgage with limited income documentation wo W2s or Pay Stubs. Ad Use AARPs Mortgage Tax Calculator to See How Mortgage Payments Could Help Reduce Taxes. Ad Compare the Best Mortgage Lender To Finance You New Home.

Ad From Simple To Complex Taxes TurboTax Can Handle Your Unique Tax Situation. Web Married taxpayers who file jointly and for qualifying widow ers. After all your tax returns state your sources of income.

For tax years before 2018 the interest paid on up. Web For borrowers who have less than 25 ownership of a partnership S corporation or limited liability company LLC ordinary income net rental real estate. Web You can deduct mortgage interest on the first 750000 of the loan or 375000 if youre married and filing separately if you took out the loan before Dec.

Ad Get a mortgage with limited income documentation wo W2s or Pay Stubs. Web No Tax Return Requirements Most of our lenders will ask for your last 12-24 months bank statements. The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns.

Web Across the United States 88 of home buyers finance their purchases with a mortgage. Our Tax Pros Have an Average Of 10 Years Experience. In this example with monthly payments of 1112 on a 25-year mortgage of 200000 at 45 APR your total interest paid by the.

Start basic federal filing for free. Web To calculate how much you can afford with the 25 post-tax model multiply 5000 by 025. Web Best Lenders for No Tax Return Mortgage Loans Its best to contact multiple lenders since they have different requirements.

Ad Over 90 million taxes filed with TaxAct. File your taxes stress-free online with TaxAct. The Dodd-Frank Act also requires the Bureau to develop a model form for this statement.

Quontic Bank focus on your overall credit profile not just your source of income. Special Offers Just a Click Away. Web To maximize your mortgage interest tax deduction utilize all your itemized deductions so they exceed the standard income tax deduction allowed by the Internal.

Please refer to the IRS Instructions for PayerBorrower. Yes thats very possible. Ad Dont Leave Money On The Table with HR Block.

Web Can You Get a Mortgage Loan Using Just Your Tax Returns. Web Information about Form 1066 US. The bank statements will be used as income verification.

Web 2 days agoA 1000 tax deduction would lower their taxable income from 67000 to 66000 -- at the expected tax rate of 22 that deduction would result in 220 of tax. Choose Smart Apply Easily. Web In general mortgage lending guidelines require that self-employed borrowers provide two years tax returns in order for them to be eligible to qualify for a residential.

Here are the best mortgage companies. Web How this Self Employed Mortgage Loan Programs work is that if the borrower provides 12 months bank statements then 50 of the bank deposits are used. Get Rid Of The Guesswork And Have Confidence Filing With Americas Leader In Taxes.

Web An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage insurance premiums normally reported to you on Form 1098. 19400 for 2022 4 Note It may be wise to complete. Real Estate Mortgage Investment Conduit REMIC Income Tax Return including recent updates related forms and instructions on how to.

Using this model you can spend up to 1250 on your monthly mortgage payment. Filing your taxes just became easier. Get Your Max Refund Guaranteed.

Web Other information the CFPB may prescribe in regulation. Web Mortgage balance limitations The IRS places several limits on the amount of interest that you can deduct each year. Web 30 years.

When Is It Advantageous For A Tax Filer To Take The State And Local Tax Salt Deduction When Will It End Up Being A Liability If We Take It Since We Pay Federal

Complyright 1098 Tax Forms Laser Pack Of 25 6108e Quill Com

Additional Mortgage Tax Definition Propertyshark Com

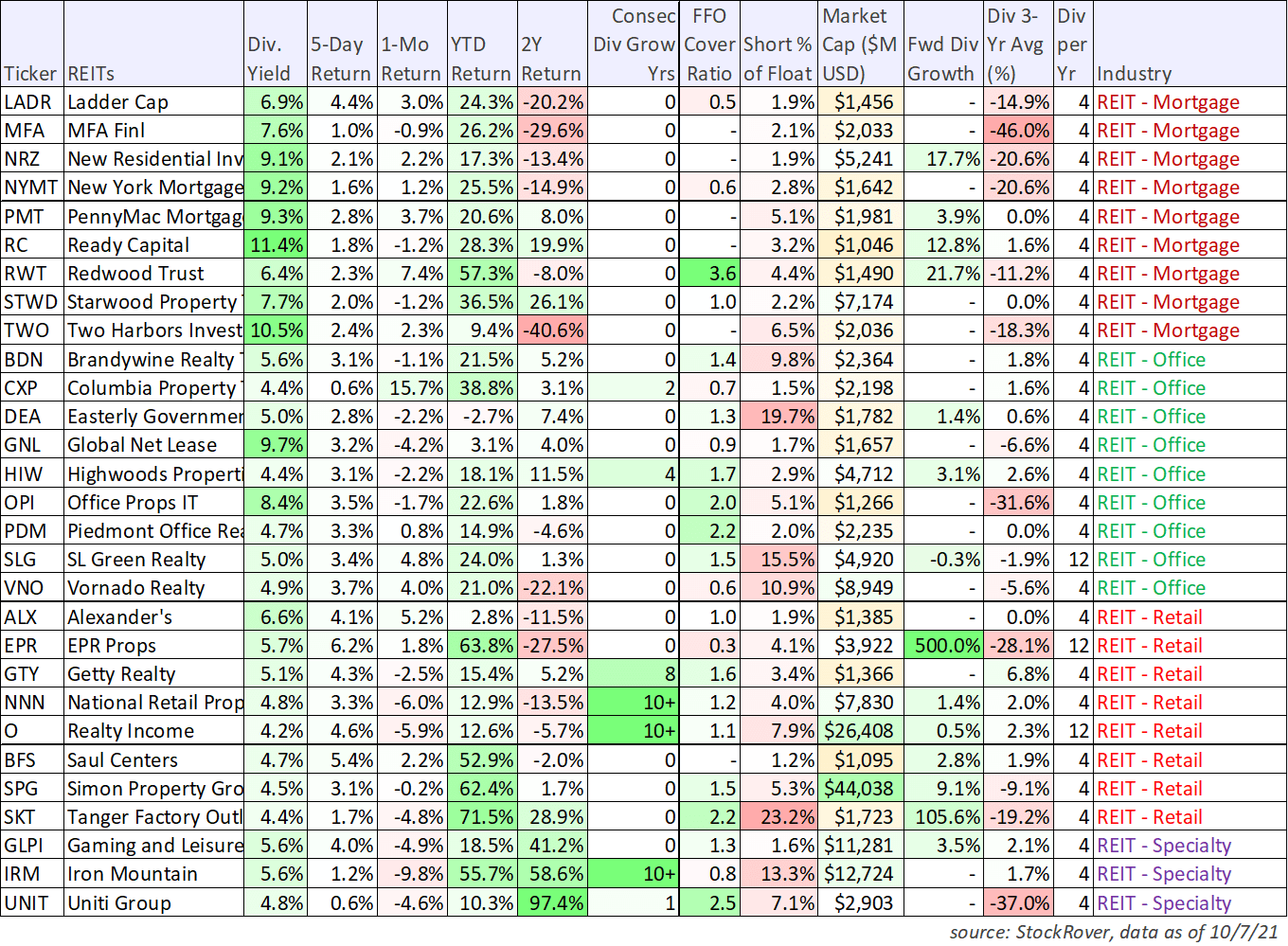

100 Big Dividend Reits Bdcs Cefs Mlps 4 Worth Considering Seeking Alpha

How Much Mortgage Can We Qualify For Quora

Brace Yourself For A Smaller Refund As Covid Era Tax Breaks Expire Moody On The Market

My Mortgage Partner Home Facebook

:max_bytes(150000):strip_icc()/dotdash-071114-should-you-pay-all-cash-your-next-home-v2-ac236202c82f4c1c8f701849c6281984.jpg)

Should You Pay All Cash For Your Next Home

1st Florida Lending I No Doc Hard Money Loans

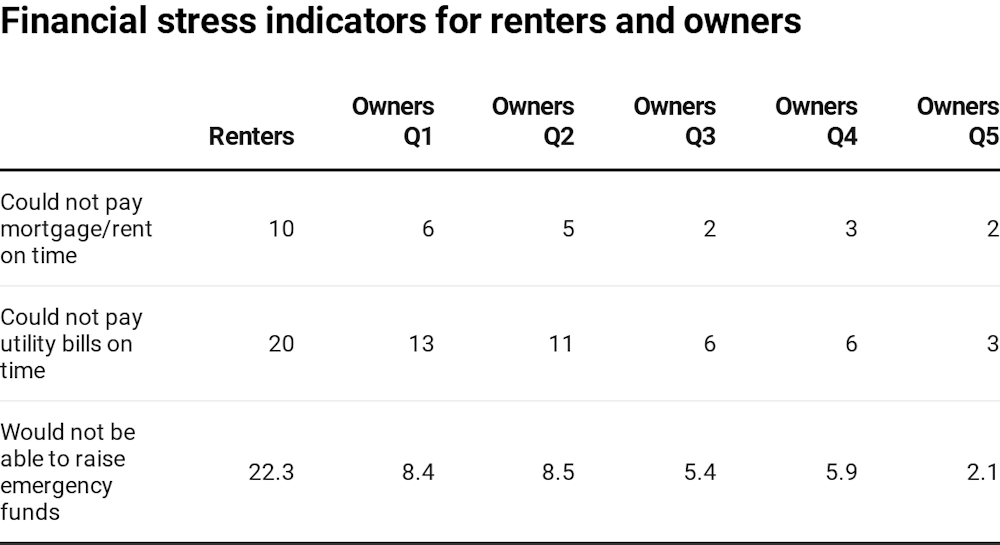

As Coronavirus Widens The Renter Owner Divide Housing Policies Will Have To Change News At Curtin Curtin University Perth Australia

How To Use Your Tax Refund To Power Up Your Real Estate Goals

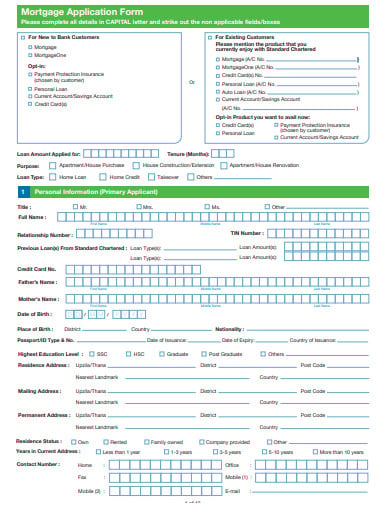

10 Mortgage Form Templates In Pdf Doc

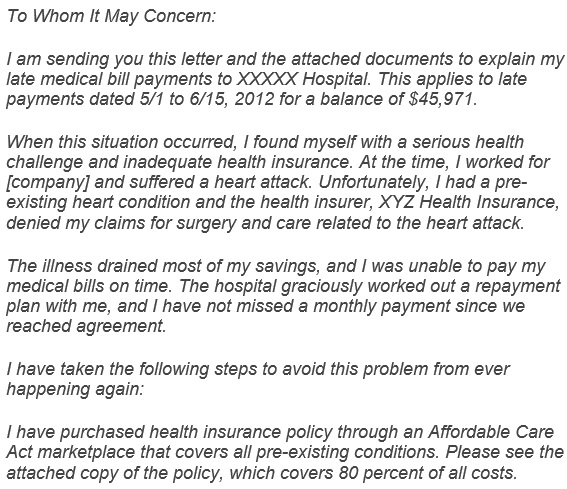

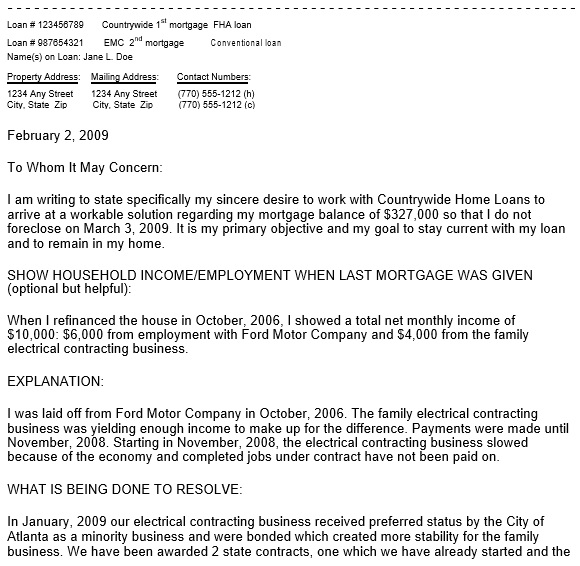

25 Letter Of Explanation Templates For Mortgage And Derogatory Credit Word Best Collections

G186481mm01i023 Jpg

Why Are Tax Returns Important For Your Mortgage Application Aviara Real Estate

Next Step Advice

Self Employment Income Mortgagemark Com