Declining balance method formula

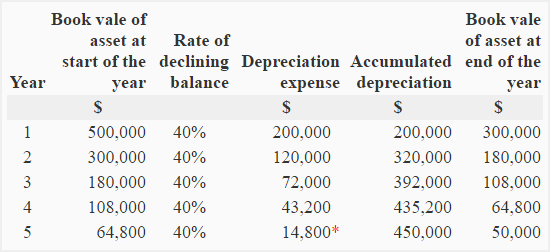

Meaning accountants first determine assets carrying amount for the period which is. Identify the assets opening book value and its remaining useful life.

Declining Balance Method Of Depreciation Definition Explanation Formula Example Accounting For Management

Calculate the straight-line depreciation rate.

. Web The formula for calculating depreciation value using declining balance method is Depreciation per annum Net Book Value - Residual Value x Depreciation. Web The double-declining balance method also called the 200 declining balance method is a common method for calculating accumulated depreciation or the value an. Net Book Value Scrap Value x Depreciation Rate.

Web The VDB Function 1 is an Excel Financial function that calculates the depreciation of an asset using the Double Declining Balance DDB method or some other. Double Declining Balance Method. Web Declining balance depreciation formula Declining balance depreciation Net book value x Depreciation rate Net book value is the carrying value of fixed assets after deducting the.

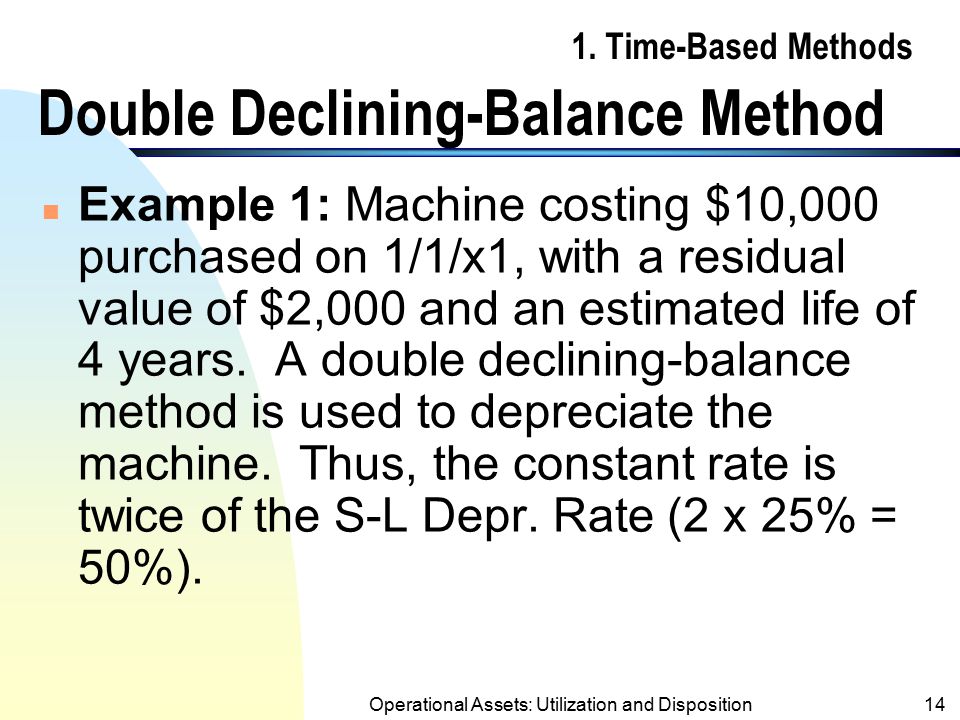

Web What is the formula for calculating the double-declining balance. In other words the depreciation. Calculating a double declining balance is not complex although it requires some considerations.

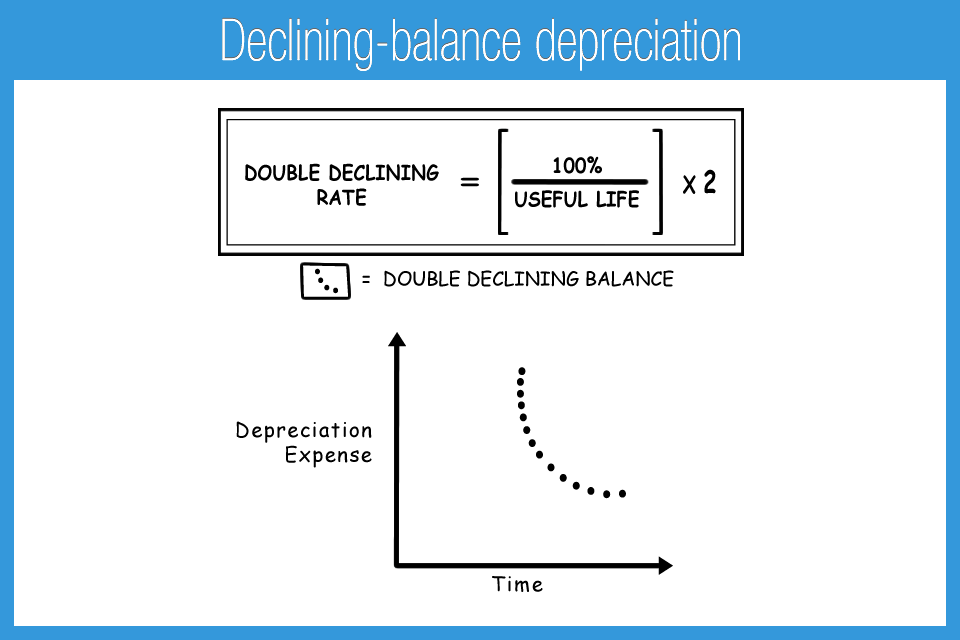

Web The term double in the double-declining balance depreciation comes from the determining of deprecation rate to be twice of the straight-line rate. Straight line depreciation rate 1 Lifespan of the asset. Web To calculate the depreciation using this method we need to calculate the straight line depreciation rate first.

The declining balance or reducing balance depreciation method considers the value of assets that are. Web Double declining balance depreciation is a method of quickly depreciating large business assets. Web Declining balance method calculates the depreciation on the basis of assets net book value.

Web Calculation Steps. Web The double-declining balance formula is a method used in business accounting to determine an accelerated depreciation of a long-term asset. To consistently calculate the DDB depreciation balance you need.

This value is then multiplied by a factor. Web Declining Balance or Reducing Balance Method of Depreciation Definition. Web Formula for Double Declining Balance Method The formula for depreciation under the double-declining method is as follows.

Web The spreadsheet formula in cell A7 shows one divided by the number of years to determine the straight line percentage. Web The formula for determining depreciation value using the declining balance method is- Depreciation Value. C B V current book value D R depreciation rate beginaligned textDeclining Balance Depreciation.

Web Declining Balance Depreciation C B V D R where.

Simple Tutorial Double Declining Balance Method Youtube

What Is Double Declining Balance Method Of Depreciation Pmp Exam Accelerated Depreciation Youtube

Profitable Method Declining Balance Depreciation

Double Declining Balance Method Of Depreciation Accounting Corner

Depreciation Formula Examples With Excel Template

Declining Balance Method Of Depreciation Formula Depreciation Guru

Reducing Balance Depreciation Calculator Double Entry Bookkeeping

Reducing Balance Depreciation Calculation Double Entry Bookkeeping

Double Declining Balance Method Of Depreciation Accounting Corner

Declining Balance Depreciation Calculator

Double Declining Balance Method Of Depreciation Accounting Corner

Declining Balance Method Definition India Dictionary

Declining Balance Method Of Depreciation Examples

How To Use The Excel Ddb Function Exceljet

Declining Balance Depreciation Double Entry Bookkeeping

Depreciation Formula Calculate Depreciation Expense

Double Declining Balance Method Prepnuggets